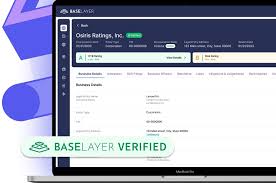

With a $6.5 million initial investment round, Baselayer, a B2B platform with headquarters in New York that uses patented Graph AI technology to combat fraud and improve company onboarding, came out of stealth.

Investors

- Eric Woodward

- The former president of Early Warning Services

- Jason Mikula

- Executives from Stripe, Brex, Valley Bank, Airbase, and fifteen other fintech startups. Other backers included Torch Capital, Afore Capital, Founder Collective, Picus Capital, and Gilgamesh Ventures.

With the money, the business intends to expand its platform, spend more heavily, and improve and add new features to its GenAI model.

Baselayer has developed a unique AI-based knowledge graph under the direction of CEO Jonathan Awad and CTO Timothy Hyde in an effort to streamline and secure the company verification process, lower fraud in the financial ecosystem, and boost small business performance.

“For a new or small business, waiting days or weeks to have access to a bank account can be devastating. Without a bank account, it’s impossible to run a business, and as fraud has gotten more sophisticated, it’s become even more difficult for banks to verify small or new companies.”

CEO and co-founder Jonathan Awad

Financial institutions and government organizations can quickly check the legality and evaluate the risk of new business clients in a matter of seconds because to its ability to foresee and distinguish between genuine and fraudulent trends.

With Rho and one of the top five loan infrastructure systems among its nearly thirty new clients acquired in less than six months, the firm has increased its entire reach to over 25 million prospective business accounts.

After only six months of its launch, Baselayer has already been integrated into systems and clients ranging from small business fintechs to traditional bank providers.

One of the top five loan infrastructure systems, for example, oversees loans for more than 25 million accounts at nearly one thousand different banks and lenders. Baselayer was used early by Rho, a commercial banking platform with integrated spend management and customer support.