It’s been a rough last 4 years for the investors of FMCG major HUL. The stock has basically given no returns since the last 4 years, whereas NIFTY broke new highs.

Though HUL is primed to reap the benefits of India’s flourishing middle class and upper middle class, with its premium end products, its revenues and brand recall hasn’t seen an uptick.

Facing a great competition from conglomerates like ITC, Reliance (jiomart), Tatas( bigbasket) and home grown startups, the last 5 years have been a quiet show for the FMCG giant.

Add in the mix Patanjali. The company promoted by saffron clad Baba Ramdev has grown from Rs 5000 crore to Rs 50000 crore in last 10 years, eclipising every vertical of HUL.

This meteoric rise of Patanjali ate the market share of HUL. It could only grow twice in revenues generated in the last 10 years.

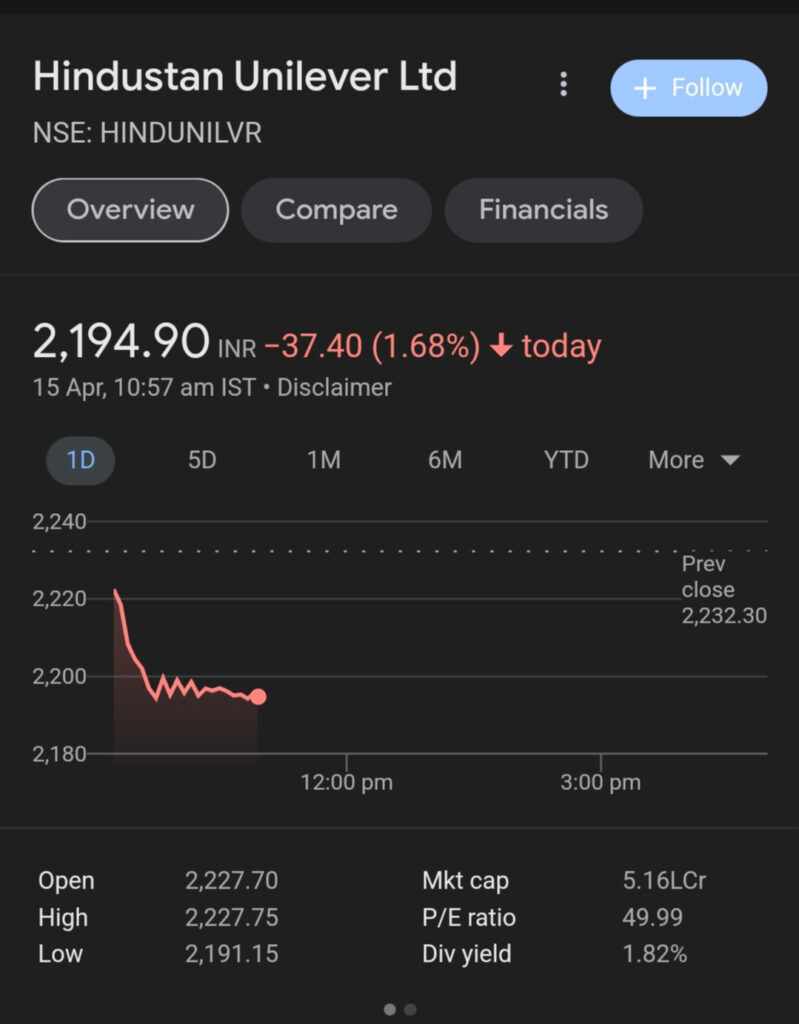

HUL had Rs 28,500 crore revenue in a fiscal year in 2014, which grew to Rs 60,000 crore in 2023. The company is debt free but trading at 10x of its book value.

The stock is in news recently as the board of directors of HUL are expected to meet on 24 April to announce dividend. Analysts expect HUL to pay Rs 40 as dividend by the company.