Shares of Newgen Software Ltd. will be in focus in trade Monday as the mid-tier technology services provider had won multiple orders on Saturday (March 30). The company has executed an agreement for a Trade Finance Project with a customer, it said in an exchange filing.

The aggregate value of the purchase order is around₹49.84 crore, and the project will be executed over a period of three years.

Additionally, Newgen Software has also won orders for a Trade Finance Solution from an international entity worth $1.1 million. The order will be completed within the next two years, the company said.

It has also received the Letter of Intent for purchase and implementation of customer onboarding, corporate finance origination system and business process automation system from an international client for a five year period. The aggregate value of the order is $2.07 million.

Newgen Software had posted a 44.5% year-on-year growth in net profit at ₹68.3 crore for the December 2023 quarter, compared to ₹47.3 crore in the Decmber 2022 quarter.

The company’s revenue rose 27% to ₹324 crore during the third quarter as against ₹255 crore from the year-ago period.

EBITA rose 35% on a sequential basis to ₹77 crore from ₹57 crore. The margin stood at 23.8%, up 440 basis points from 19.4% in Q2FY24.

Newgen Software also said that it logged 11 new customer logo additions in the December quarter.

Foreign brokering firm Jefferies had raised its price target on Newgen Software to ₹1,070 from ₹870 per share. However, the brokerage retained its rating unchanged to ‘Buy’ as it believed the growth momentum will sustain.

Earnings per share estimate for financial year FY24 to FY26 was raised to 5% as Jefferies saw higher margin estimates and lower tax rates from SEZ benefitting the firm. Further, it expected the company to post 26% earnings per share on a compounded annual growth rate over FY25 – FY26 on the back of ‘the strong growth outlook and visibility.’

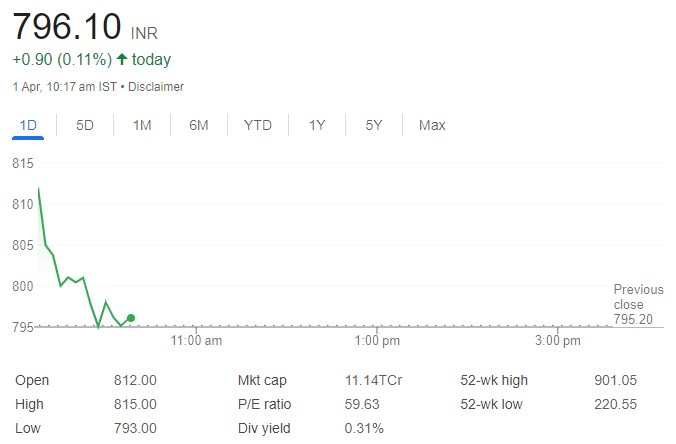

On Thursday, shares of Newgen Software settled 1.02% higher at ₹796 apiece on the NSE. The stock has given almost flat returns so far this year, rising 0.12%.