The upcoming Nvidia GTC conference has created hype around AI tokens, highlighting growing investor interest in the field.

Render [RNDR] and Fetch.ai [FET] have seen similar upticks in value over the past few days, reflecting the market’s anticipation of potential advancements in artificial intelligence technology.

Here for the long run?

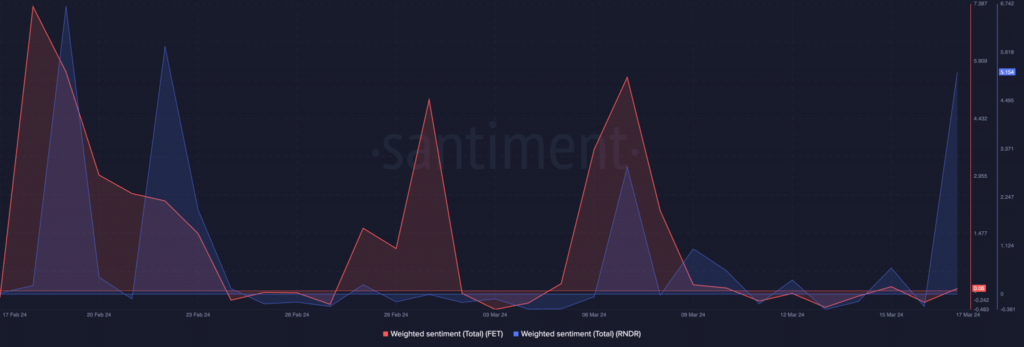

The social volume for both RNDR and FET has surged in recent days, indicating heightened interest and engagement among investors.

However, sentiment surrounding FET declined, suggesting that negative comments on social media have outweighed positive ones, potentially posing challenges for further price growth.

Coming to RNDR, sentiment around the AI token remained relatively high at press time, hinting at sustained optimism among investors.

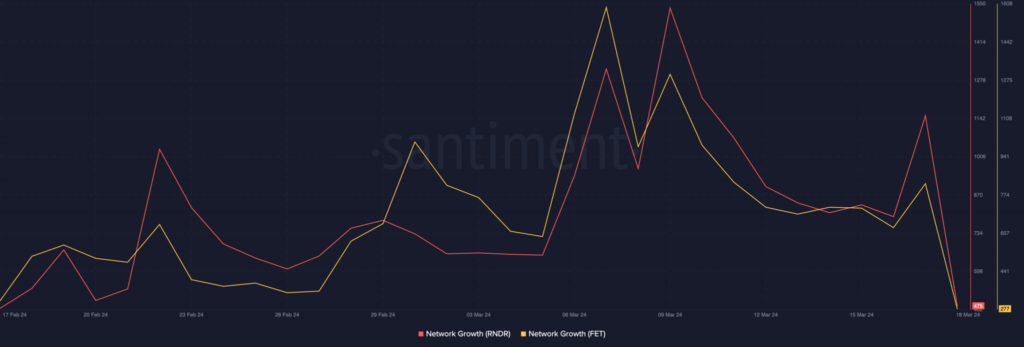

However, Network Growth for both FET and RNDR slowed, showcasing a decline in interest from new addresses.

This implied that the recent surge in prices may be driven primarily by existing holders accumulating more tokens.

The MVRV (Market Value to Realized Value) ratio for RNDR and FET remained high at press time, indicating that despite accumulation, most addresses are still profitable.

A high MVRV ratio suggests that most investors are in profit, potentially leading to profit-taking and selling pressure.

Additionally, the price movement of both tokens exhibited similarities, with higher highs and higher lows over the past month, indicative of a bullish trend.

This pattern suggests that despite short-term fluctuations, there is an underlying positive sentiment driving the market for both RNDR and FET.

Traders turn bearish

As of the latest data, RNDR is trading at $12.41, marking a 9.12% increase in the last 24 hours. Conversely, FET has experienced a slight decline of 1.38% during the same period, trading at $2.65.

Interestingly, short positions around FET have grown to 52% in recent days, reflecting a bearish sentiment among some investors.

Similarly, short positions around RNDR have also increased, reaching up to 51% during this period.