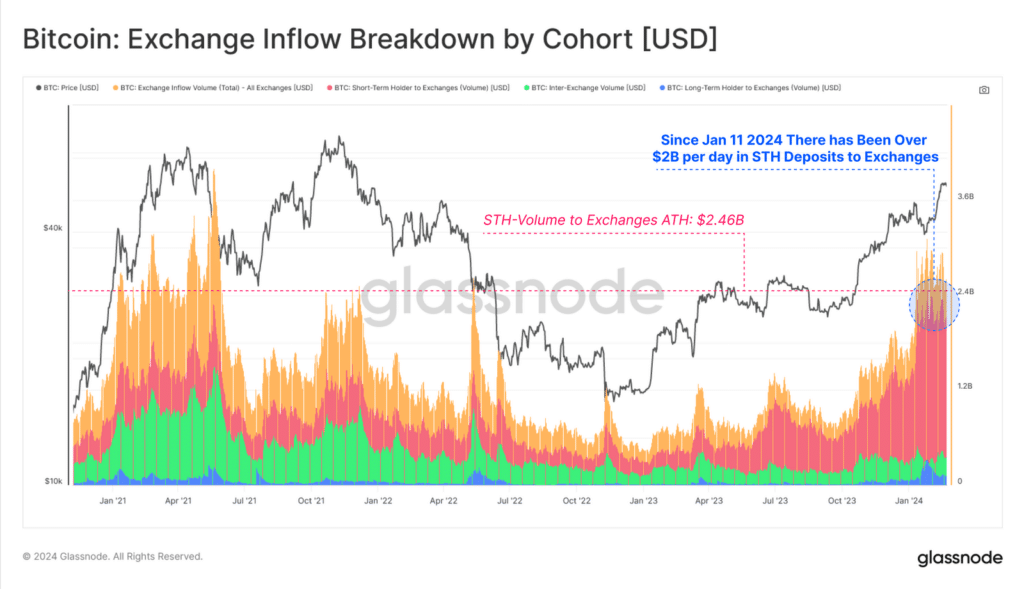

With Bitcoin reaching the $58,000 milestone, short-term holders have set a new all-time high in the volume deposited to centralized exchanges, according to Glassnode.

Crypto exchanges are witnessing an influx of short-term holders, who have consistently deposited over $2 billion worth of Bitcoin per day in volume since mid-January, whilst also setting a new maximum of $2.46 billion in volume deposited overall, a recent research report by Glassnode indicates.

As investors are holding huge amounts of unrealized profits since November 2022, the total volume of deposits and withdrawals has continued to expand, reaching $5.57 billion in daily volume flowing in and out of exchanges, analysts note.

“The degree of speculation within the current market can also be seen by the extraordinarily high dominance of exchanges related in/outflows with respect to all on-chain volume.”

Glassnode

The data provided by the Switzerland-headquartered analytical blockchain firm indicates that over 78% of all economical on-chain volume is being directed to/from exchanges as Bitcoin keeps updating its heights.

However, the surge in activity is not solely attributed to the recent rally, as the introduction of new spot Bitcoin exchange-traded funds (ETFs) has also contributed to increased demand. These ETFs have attracted approximately 90,000 BTC in net flows, totaling nearly $38 billion in assets under management.

“These ETF products have for the first time allowed institutional investors to gain exposure to the BTC asset via traditional rails, opening a new degree of freedom for demand and speculation.”

Glassnode

Analysts at QCP Capital anticipate Bitcoin’s realized volume to remain around 40%, suggesting that hitting the $60,000 mark is a natural target for the March expiry. As of press time, Bitcoin is trading at $58,692, a level not seen since November 2021, according to CoinMarketCap data.