After raising roughly $300 million, the company was valued at $1.5 billion in the latter part of last year.

Since Intuitive Machines became the first private company to successfully land a spacecraft on the moon—the first American landing on the lunar surface in more than 50 years—interest in space companies has increased dramatically.

Even if the lander tilted sideways on the moon, the company is probably going to finish the mission and demonstrate the viability of these kinds of startups. The private space business is booming and is expected to reach a valuation of $770 billion by 2027. Some analysts predict that “New Space” companies will hold a significant portion of this market due to the declining cost of rocket launches.

Here are some firms working toward exploring the opportunities:

INTUITIONAL TECHNIQUES

Two further trips are planned by Intuitive Machines (LUNR.O), opens new tab, which is run by former NASA workers.

The purpose of these missions is to assess the viability of using the Moon’s resources for future exploration and to provide NASA with additional research tools on the lunar surface.

The Texas-based corporation obtained $118 million in funding from the U.S. space agency’s Commercial Lunar Payload Services (CLPS) program to create the moon lander, and went public in February 2023 through a merger with a blank-check firm.

SPACEX

With a valuation of over $180 billion, Elon Musk’s SpaceX is among the most valuable businesses in the world. With its broadband satellites and reusable rockets, SpaceX has been leading the private sector’s efforts in the space industry in recent years. Next month, the most potent rocket of its type, Starship, is scheduled for its third launch.

The billionaire has stated that landing on Mars is the long-term goal, with the intention of establishing a sustainable colony there and cutting down on space travel expenses.

According to Musk, the company’s Starlink constellation—which consists of over 5,000 satellites—has reached cash flow break-even and offers internet service to some regions of the planet.

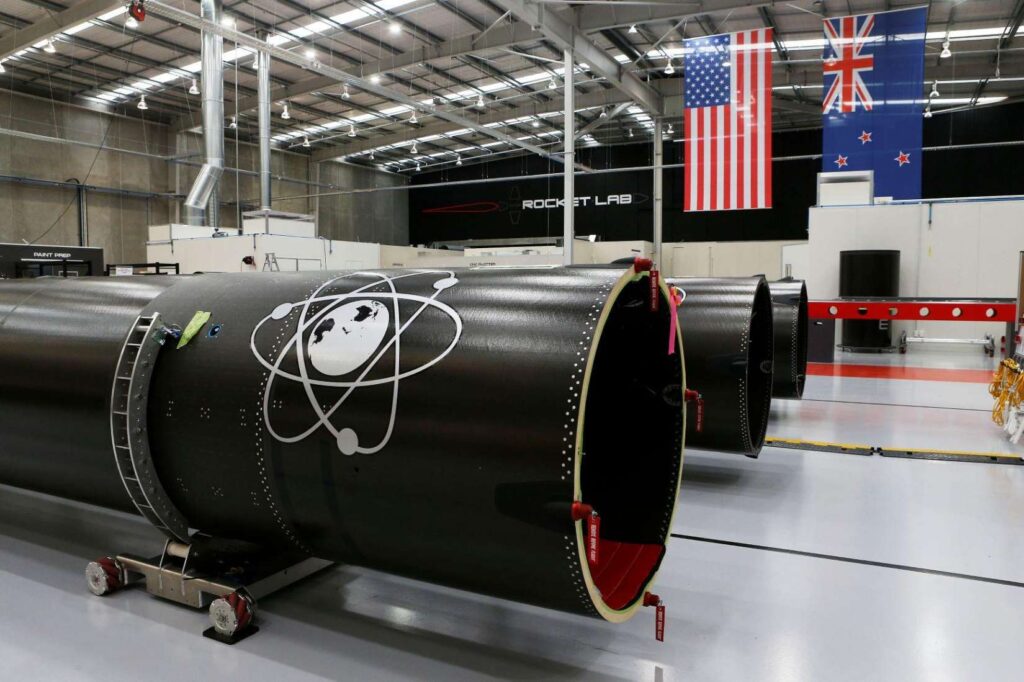

ROCKET LAB

Peter Beck, a New Zealander, established Rocket Lab (RKLB.O), opens new tab, which went public in the United States in 2021 after merging with a special purpose acquisition business.Given that it is the most frequent private rocket launcher after SpaceX, analysts view it as one of the more promising “New Space” enterprises. Later this year, the business, which is well-known for using its small rocket, the Electron, to launch satellites into specialized orbits, is anticipated to test its reusable Neutron rocket.

The rocket’s design enables trips to Mars and Venus in addition to delivering a huge number of satellites into low Earth orbit.

Numerous federal contracts worth hundreds of millions of dollars are held by Rocket Lab in the United States. These contracts cover the company’s production of satellites, spacecraft launches, and an agreement to investigate the use of rockets for cargo delivery worldwide. BLUE ORIGIN

At a total contract value of $3.4 billion, NASA has chosen Blue Origin, the aerospace firm that billionaire Jeff Bezos established, to construct its Blue Moon human landing technology for the Artemis V mission.Additionally, the agency gave Blue Origin $35 million last year to develop its Blue Alchemist technology, which uses broken rock and moon dust to produce oxygen and solar cells on its own.

Additionally, the corporation faces competition from Virgin Galactic (SPCE.N), the British business billionaire Richard Branson’s latest venture into space tourism.

FIREFLY AEROSPACE

The Cedar Park, Texas-based business is developing the Blue Ghost lander, which will carry three payloads under the CLPS program this year, in addition to private and government cargo.Supported by AE Industrial Partners, Firefly is working to mass-produce its medium-sized rocket while simultaneously creating the first stage of Northrop’s Antares rocket, which will be launched in August 2022 as an all-American rocket.

The National Reconnaissance Office selected the business last month to be the launch provider for a 10-year contract for up to $700 million.