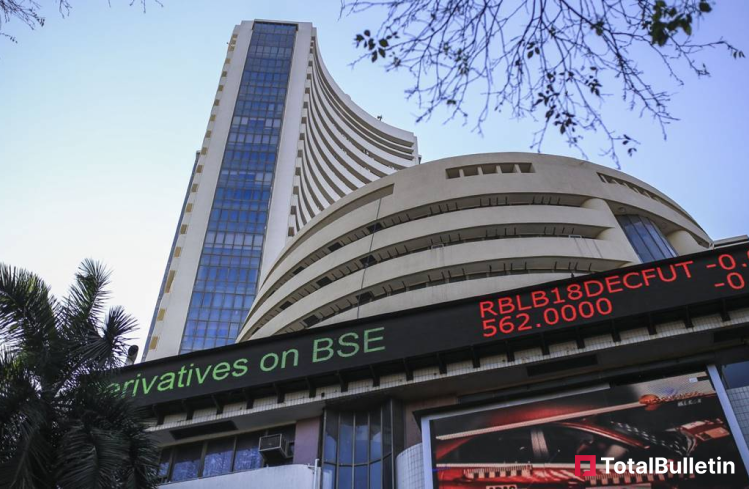

The Indian equity indices recorded new highs on Tuesday, April 9. Sensex crossed the 75,000 mark for the first time, and Nifty50 surpassed the 22,750 level, helped by sustained inflows from domestic investors and financial updates from companies ahead of the earnings season.

Last seen, both indices were up over 0.20 per cent. The BSE Sensex traded 189.86 points higher at 74,932.36 while the NSE Nifty was up 54.05 points at 22,720.35.

“The pattern of ‘higher highs and higher lows’ is a distinct bullish signal, and this has been the standout pattern in the Indian market this year. Consequently, the buy-on-dips strategy has consistently worked for investors. The new records set by the market yesterday confirm the bullish market undertone. A healthy and desirable trend in the market movement yesterday was the outperformance of the large-caps. This trend is likely to continue,” said Dr. V K Vijayakumar, Chief Investment Strategist, at Geojit Financial Services.

Dr. Vijayakumar added that it is important to understand the fact that in this richly valued market, there is valuation comfort in large-cap banking stocks. More importantly, the Q4 results of the banking majors are likely to be very good. Sectors like capital goods, autos, cement, and hospitality are likely to remain resilient.

In the broader market, Nifty Mid Cap 100 and Small Cap 100 traded in positive territory, mirroring the gains for the headline indices. High-beta Nifty Bank was up 0.13 per cent at 48,643.25.

BUZZING STOCKS

UCO Bank shares were up over 1 per cent after total business as of March 31 increased by 9.62 per cent to Rs 4.50 lakh crore year-on-year (YoY).

Godrej Properties shares were up over 6 per cent after the company released its Q4 update.

Sula Vineyards shares were up over 2 per cent after the company released its Q4 update.

Anand Rathi Wealth shares traded over 5 per cent higher as its board would consider a buyback of shares on April 12.

Sharda Motor Industries shares were up over 9 per cent after its board announced it would consider a buyback of shares on April 18.

KSB shares were up over 2 per cent as the company’s board is slated to discuss Q4 results and buyback of shares in a meeting on April 26.

Conversely, Gland Pharma shares were down over 5 per cent after 5.3 per cent equity changed hands via multiple block deals.

GLOBAL MARKETS

Industrial metals prices extended their gains on Tuesday with expectations of a worldwide manufacturing rebound, while Asian shares crept up a little more cautiously ahead of this week’s U.S. inflation data and a crucial European Central Bank meeting.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.2 per cent. Japan’s Nikkei rose 0.6 per cent.