Shares of PNB Housing Finance Ltd. rallied nearly 15% in Monday’s trade because of three key reasons. Firstly, CARE Ratings upgraded PNB Housing to ‘AA+’ from ‘AA’ with a ‘stable’ outlook from ‘positive’ earlier due to its improving asset quality and strong market position.

Further, revision of rating continues to factor in PNB Housing’s strong market position as the third-largest housing finance company in the country on loan asset basis as on December 31, 2023, along with a well-diversified resource profile, the company said.

The ratings upgrade is applicable to a range of facilities and debt instruments, including its long-term and short-term bank facilities, bonds, non-convertible bonds, tier-2 bonds, and fixed deposits.

Secondly, ratings agency ICRA upgraded the housing finance company’s non-convertible debentures (NCDs) rating to ‘ICRA AA+’ from ‘ICRA AA’, revising the outlook to ‘stable’ from ‘positive’.

ICRA said the rating upgrade factors in the sustained improvement in PNB Housing Finance’s credit profile, driven by the improved asset quality metrics and the strengthened capitalisation profile.

Given the intense competition in the mortgage finance business, the company’s ability to maintain its net interest margin while improving its operating efficiency and controlling the credit costs will be important from a credit perspective, the ratings agency stated.

Also, global brokerage firm Morgan Stanley assigned an ‘Overweight’ rating on the PNB Housing Finance stock with a target price of ₹970 per share.

Morgan Stanley’s call comes after CARE Ratings and ICRA upgraded the housing finance company’s long-term rating to ‘AA+’. The ratings upgrade is also supported by PNB Housing Finance’s strengthened capital position and diversified resource profile, it said.

In a note, Morgan Stanley also highlighted that the fourth quarter typically sees strong performance for housing finance companies due to loan growth and improved asset quality.

With valuation standing at 1 times FY25 P/B (price-to-book) and 9 times P/E (price-earnings), PNB Housing appears attractive to investors, the foreign broking firm noted.

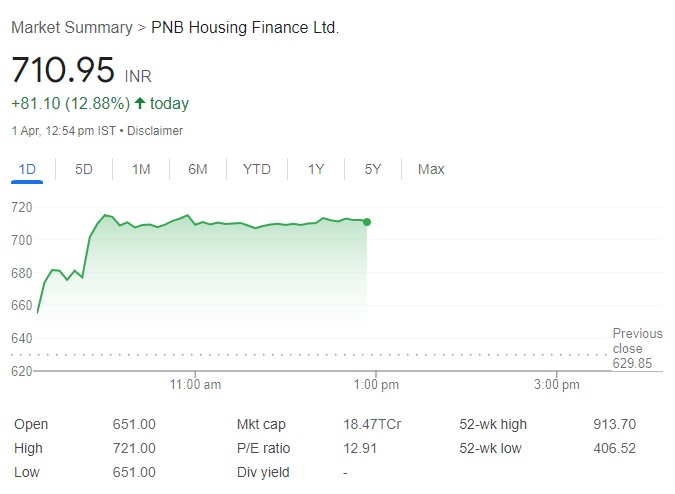

At 12:30 pm, PNB Housing Finance shares were trading 13% higher at ₹712 on the NSE. The stock has been a laggard so far this year, with negative returns of 9% as against frontline index Nifty 50, which has delivered 3.37% returns during this period.