Summary

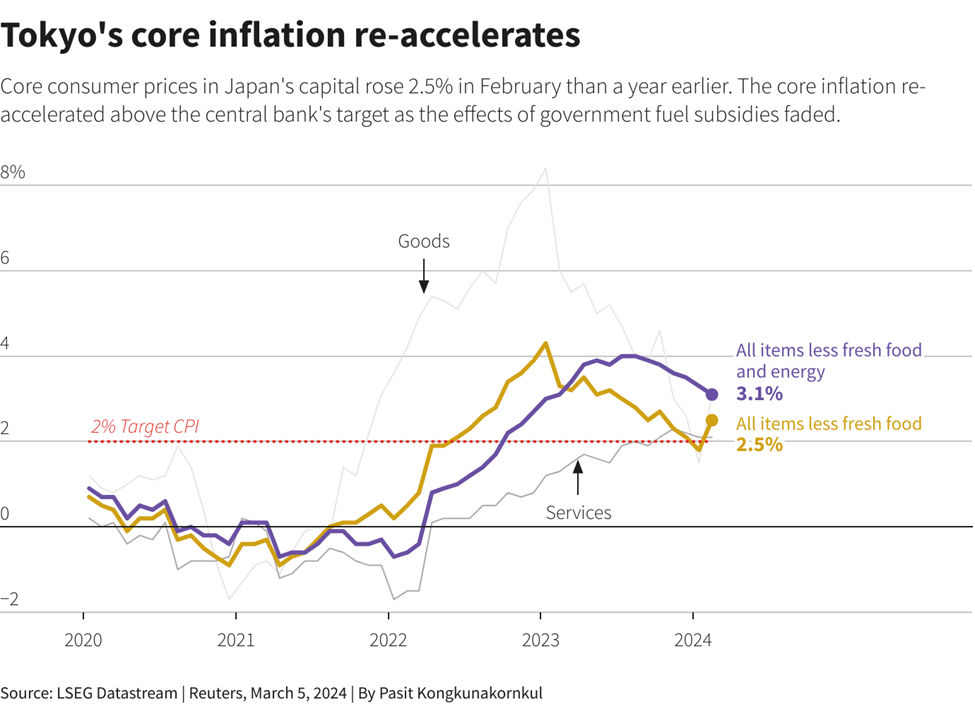

- Tokyo Feb core CPI rises 2.5% yr/yr, matching forecast

- Index excluding fresh food, fuel rises 3.1% yr/yr in Feb

- Unfazed by recession, BOJ seen eyeing near-term stimulus exit

However, an index that strips out the effect of energy costs, which is viewed as a sign of the broader pricing trend, has slowed, shifting the attention to whether Japan can see pay increases substantial enough to support spending.

The data will be one of several factors considered by the Bank of Japan (BOJ) ahead of its policy-setting meeting on March 18-19 when deciding whether to phase out its enormous stimulus programme.

The core consumer price index (CPI) in Tokyo, a leading predictor of national figures, increased 2.5% in February from a year ago, matching market expectations, data revealed on Tuesday.

The gain in the core index, which excludes the impact of fluctuating fresh food prices, came after a 1.8% increase in January.

A separate index that eliminates the influence of fresh food and fuel expenses grew 3.1% in February compared to the previous year, slowing from a 3.3% increase in January. It was the weakest yearly rate of growth since February 2023.

“The disinflation isn’t very broad-based as it mostly reflects a slowdown in processed food inflation. “There’s nothing in today’s report that would prevent the Bank of Japan from ending negative interest rates next month.”

Marcel Thieliant, Head of Asia-Pacific at Capital Economics

Japan unexpectedly entered a recession at the end of last year, with the GDP contracting by an annualized 0.4% between October and December due to sluggish business and household expenditure.

However, with inflation having risen beyond 2% for more than a year and the likelihood of significant wage increases looming, many market participants expect the BOJ to abandon its zero interest rate policy by April.

Last week, BOJ Governor Kazuo Ueda stated that it was premature to declare that inflation was on track to fulfill the central bank’s 2% target on a sustained basis. However, he stated that the economy was improving moderately and displaying positive indicators for wage growth.

In an endeavor to reflate GDP and maintain inflation stable at its 2% inflation objective, the BOJ now guides short-term interest rates at -0.1%.