The Seattle startup (Former AWS) that describes its product as the “world’s fastest spreadsheet” just raised $3 million to take on the likes of Microsoft and Google with a spreadsheet tool designed for complex analysis or big datasets.

Founded in 2021 by former engineers at Amazon Web Services, the company is targeting a wide range of customers that use Row Zero for business intelligence, finance, operations, marketing, and more.

It’s aiming to fill a gap between pricey spreadsheet tools and software that requires programming skills.

“Our biggest customers are enterprise data teams who see Row Zero as a BI tool disguised as a spreadsheet,” said CEO Breck Fresen. “They use us to give their business access to the data warehouse in an interface everyone knows how to use.”

They both spent more than five years at AWS. Fresen was a principal software engineer working on the S3 storage service. End was a senior manager of product management before departing in 2020 to become vice president of product at Seattle startup Tasso.

In a news, End explains why Microsoft Excel can get slow due to limited computing and memory capabilities on a local computer. Excel has features designed for advanced datasets but “they don’t provide the same simple and flexible spreadsheet experience as normal Excel,” End writes.

There are several other spreadsheet tools on the market and many related startups that have failed, including Spreadsheet.com, which announced its shutdown this month after it was “unable to achieve venture-scale growth.”

Row Zero said it separates itself with its speed.

“Our differentiator is outstanding performance with the spreadsheet interface everyone knows,” Fresen said.

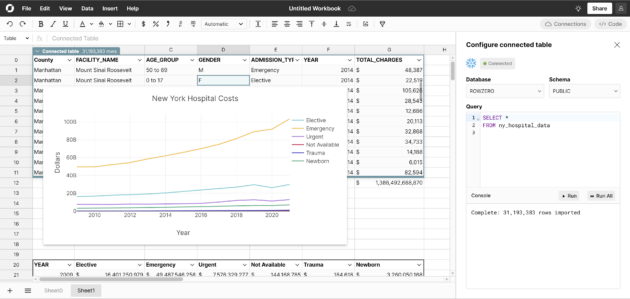

The software can import 31 million rows from Snowflake in 12 seconds. The largest dataset imported thus far has been 270 million rows of genomic data.

Row Zero has some parallels to Airtable, the no-code cloud-based spreadsheet/database company that was valued at $11.7 billion but laid off 27% of its workforce last year.

Row Zero generates revenue with a traditional software-as-a-service model, charging monthly subscription fees.

Founders’ Co-op, Ludlow Ventures, Wes McKinney, and GTM Fund invested in the seed round.