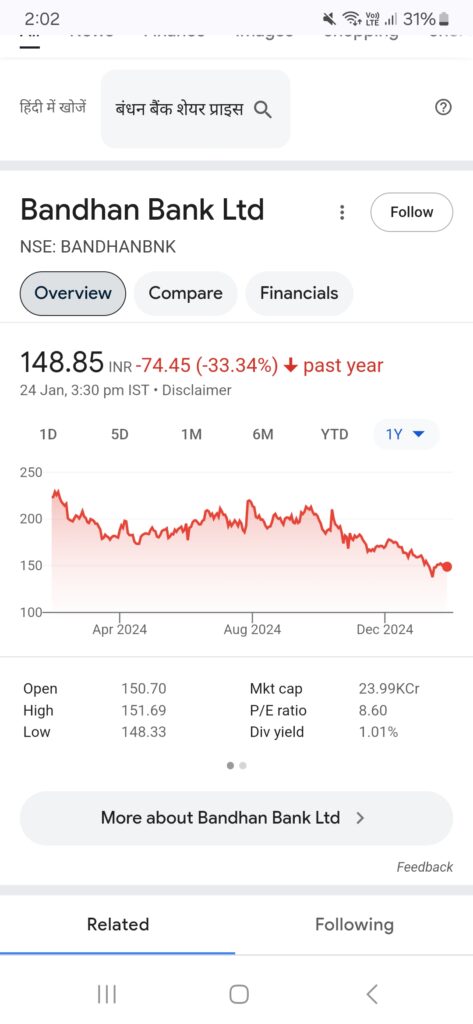

Bandhan Bank’s latest quarterly results are out. Stock has got a lot of beating in the last one year or so.

So, if you’re interested in the Indian banking sector or following the Bandhan Bank share price, this article is for you. We’ll cover the highlights of their performance, key financial metrics, and what it means for investors.

Bandhan Bank Q3 FY2025 Results: Key Highlights

- Bandhan Bank’s Net Profit in Q3 2025

- The bank posted a 30% rise in net profit, reaching ₹937 crore, compared to ₹721 crore in the same quarter last year. This jump reflects improved operational efficiency and growth in core banking activities.

- Net Interest Income (NII) Growth

- The net interest income of Bandhan Bank increased by 21% year-on-year, reaching ₹2,948 crore. This shows strong growth in the bank’s lending business.

- Asset Quality: Gross and Net NPA Trends

- A significant improvement was seen in Bandhan Bank’s asset quality. Gross NPAs dropped to 4.68% (from 7.32% last year), and net NPAs reduced to 1.29%. This signals better loan recovery and risk management.

- Deposits and Advances Growth

- Bandhan Bank’s total deposits grew by 27%, reaching ₹1.43 lakh crore. Meanwhile, its loan portfolio expanded by 21%, showcasing strong demand in its core microfinance and small-loan segments.

- Focus on Retail and Rural Banking

- The bank continues to focus on microfinance loans in rural India, a key driver of its revenue. Its emphasis on providing financial access in underbanked regions is a big growth story.

What Does This Mean for Bandhan Bank Investors?

If you’re searching for “Bandhan Bank stock performance 2025” or evaluating whether to invest, these results offer a mixed outlook. Here are some things to consider:

- Positives: Strong profit growth, improving NPAs, and consistent deposit inflows.

- Concerns: While NPAs are improving, they are still relatively high compared to larger private banks. Microfinance portfolio is a major concern.

For long-term investors, Bandhan Bank’s focus on expanding in untapped markets and its dominance in microfinance make it a strong contender. However, the Bandhan Bank share price forecast will depend heavily on how microfinance sector plays out in the next couple of quarters and how well the bank manages its NPAs and sustains profitability.