Eight weeks after it went on sale, Bank of America’s Merrill Lynch and Wells Fargo will let customers with brokerage accounts buy spot Bitcoin (BTC) ETFs in response to massive demand. The news was initially broken by Bloomberg, which cited unidentified sources with firsthand knowledge of the situation.

Some of the biggest asset managers in the United States, such Fidelity and BlackRock, are among the issuers of Spot Bitcoin ETFs. But at first, wirehouses and conventional banks declined to provide the product to clients. As previously reported by crypto.news, Vanguard, Citi Bank, and UBS shunned the Bitcoin-backed investment vehicle at launch.

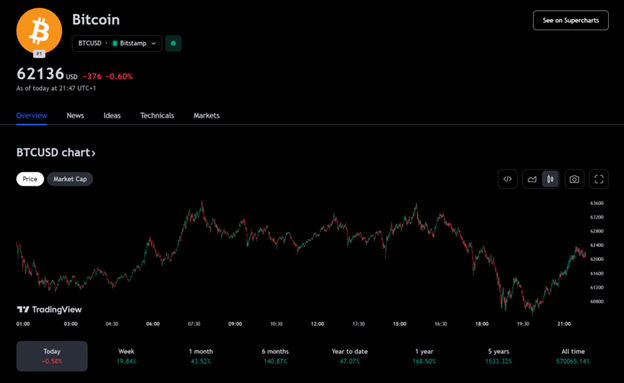

Still, spot Bitcoin exchange-traded fund (ETF) providers have accumulated more than $20 billion in assets under management (AUM), supported by rising Bitcoin values. As the ETF wrapper takes money from regular investors, hedge funds, and other capital controllers, the token has increased in value by about 50% so far this year.

Spot Bitcoin ETFs capture tradfi stakeholders

In January, platforms from Citigroup and UBS started to allow a limited number of consumers to buy spot Bitcoin ETFs. Additionally, Wells Fargo and Merrill Lynch will provide Bitcoin exposure to their clients upon request.

Morgan Stanley, another mainstay of Wall Street, is apparently considering giving its customers access to spot BTC ETF trading. Chief investment officer of Bitwise Matt Hougan told CNBC that additional trading firms would probably join the market and use ETFs to convert billions of dollars’ worth of shelved wealth into Bitcoin.