SUMMARY

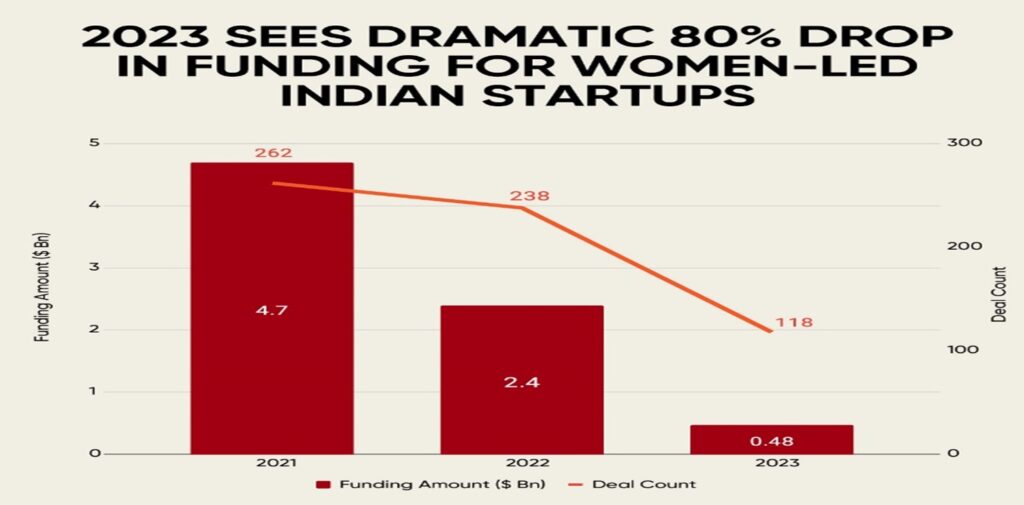

- According to a report, Indian Tech Startup Funding 2023 Report, women-led firms raised $480 million or more in 2023, up from $2.4 billion in 2022.

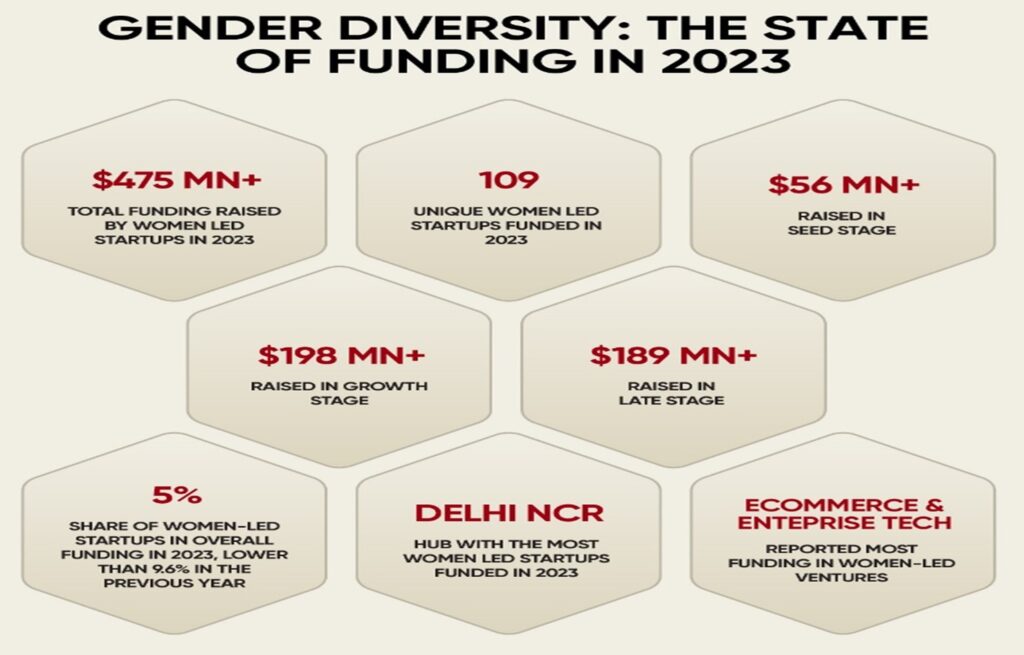

- In 2023, women-led businesses received 5% of the total capital raised, which was $10 billion.

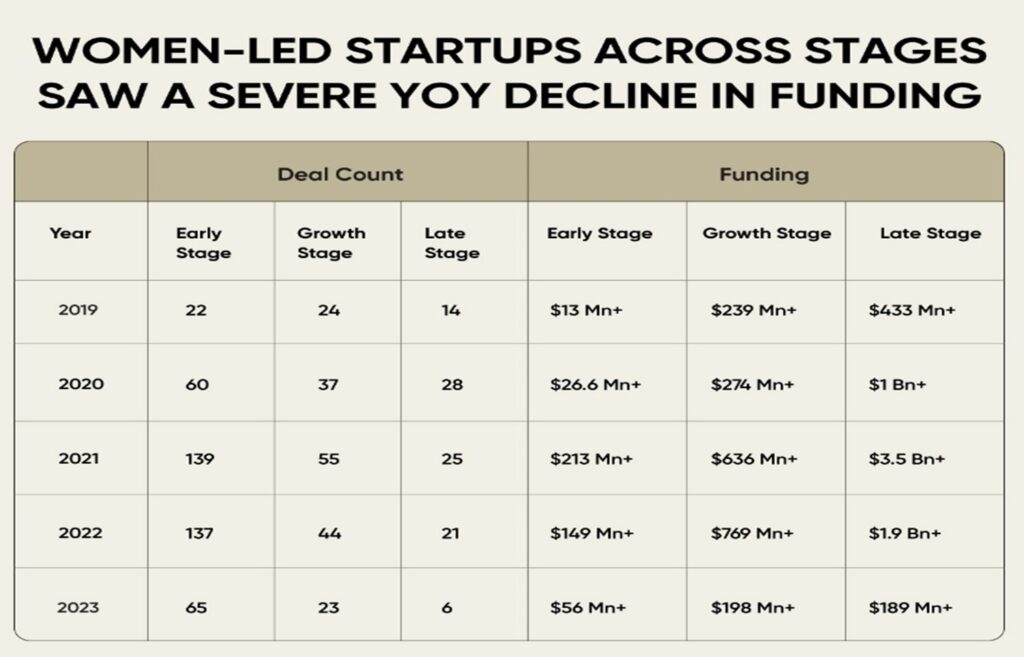

- Excluding 2021 and 2022 as outliers, women-led early stage firms raised $56.6 million across 65 deals in 2023, compared to $26.6 million across 60 deals in 2020.

Do all companies suffer equally when an unusual winter of finance freezes a thriving ecosystem? The year 2023 proved to be difficult for Indian entrepreneurs, as total funding fell to levels last seen in 2017, marking a seven-year low. Many women-led firms failed to acquire venture capital despite significant progress made towards gender equality, as finance dried up across genres and sectors regardless of fundraising phases.

India is not the only victim. PitchBook-NVCA Venture Monitor reports that in 2023, U.S. startups with a female founder received 26.1% of the overall venture capital (VC) pool, although all-women founding teams only received 1.8% of the deal value. According to a Reuters analysis, female-led firms in the EU only raised 2% of funding even in 2021, a year that saw a boom in venture capital investments.

“Regarding industries, the e-commerce industry witnessed the most number of agreements (42) for women-led companies in 2023, followed by enterprise tech (18) and edtech (12). But according to a study conducted in 2023, enterprise tech led the transaction volume with $157 million raised, ahead of fintech ($52 million) and ecommerce ($114 million).”

Indian Tech Startup Funding 2023 Report states that women-led firms raised $480 million or more in 2023, an 80% decrease from the $2.4 billion or more they obtained the year before. Women-led businesses had a more than 50% decline in transaction count in 2023, from 238 in 2022 to 118. We have included all-women teams, female solopreneurs, and co-led entities having at least one female founder in the Indian context.

What Actions Is The Indian Government Taking To Address Uneven Funding

Venture capital funds were criticized last year by Smriti Irani, the Union minister for women, child development, and minority affairs, for their inadequate backing of women-led enterprises. She emphasized how many female entrepreneurs are trying to break into the science and technology fields, but they are having trouble finding sufficient finance.